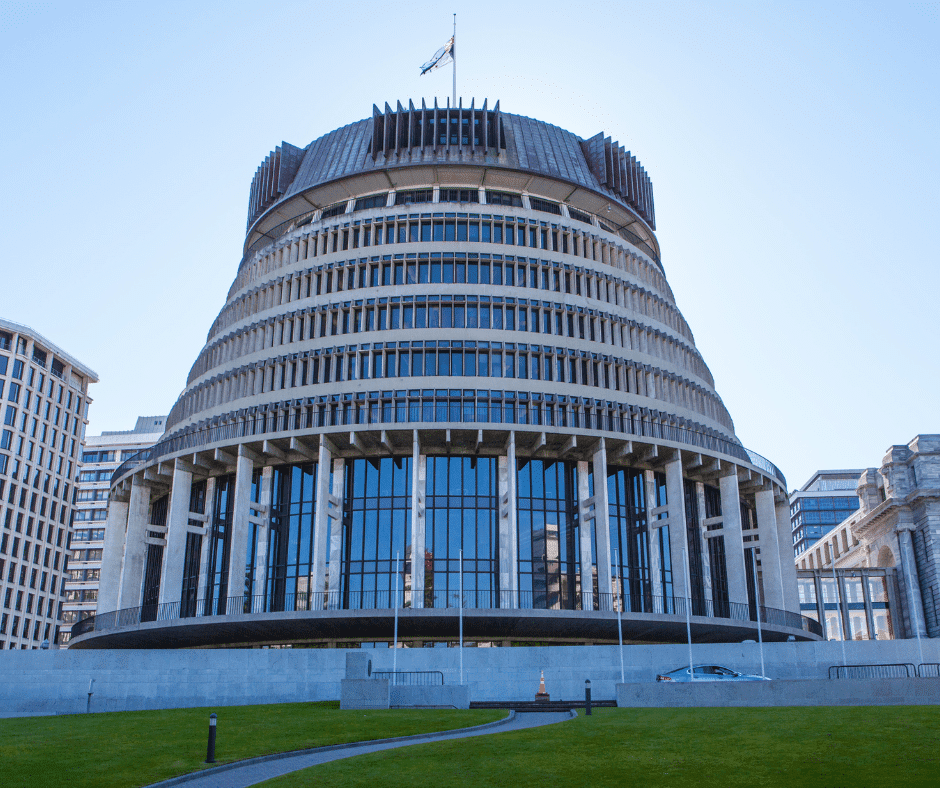

NZ Minor Parties’ Tax Policies

New Zealand’s general election on 14 October 2023 is fast approaching. As is customary, tax policies continue to be a prominent subject of debate as the election approaches. During the lead up to the election, the various political parties’ tax policies have been grabbing headlines. Some parties advocate for sweeping alterations to our tax system, […]